In recent years, the term “cryptocurrency” has become a buzzword that resonates across various sectors of society. At its core, cryptocurrency is a form of digital or virtual currency that employs cryptography for security. This technology ensures that transactions are secure and that the creation of new units is regulated.

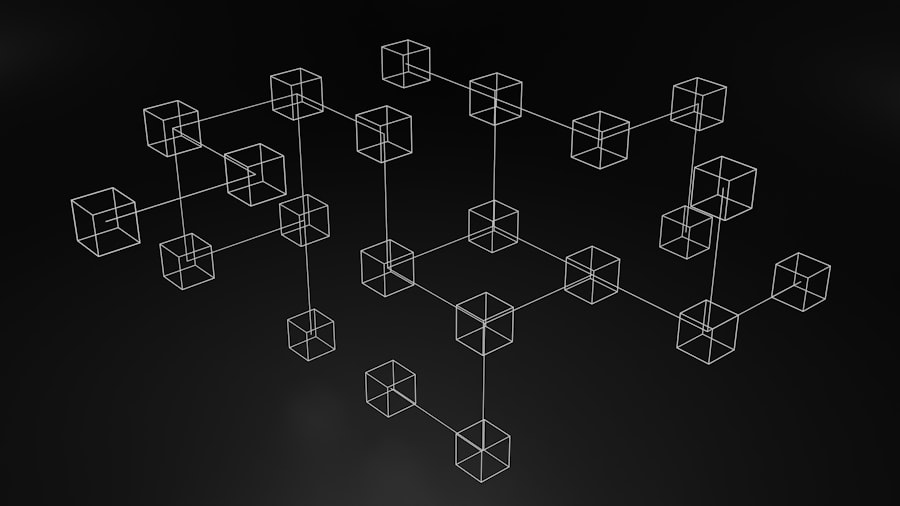

Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This decentralized nature means that no single entity, such as a bank or government, has control over the currency, which can be both liberating and daunting. As we delve deeper into the world of cryptocurrency, we find that it encompasses a wide range of digital assets, each with its unique features and purposes.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies, often referred to as “altcoins,” have emerged, each aiming to address specific issues or improve upon the limitations of Bitcoin. Understanding these foundational concepts is crucial for anyone looking to navigate the complex landscape of digital currencies.

Key Takeaways

- Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central bank.

- The popularity of cryptocurrency has risen significantly in recent years, with more people investing and using it for transactions.

- There are over 10,000 different cryptocurrencies available, each with its own unique features and uses.

- Beginners should research and understand the market before investing in cryptocurrency, and consider using a secure wallet for storage.

- Investing in cryptocurrency comes with both risks and rewards, including the potential for high returns but also the possibility of significant losses.

The Rise of Cryptocurrency: A Look at its Popularity

The popularity of cryptocurrency has surged dramatically over the past decade, capturing the attention of investors, technologists, and everyday individuals alike. This rise can be attributed to several factors, including the increasing acceptance of digital currencies by mainstream businesses and the allure of potential high returns on investment. As we observe this trend, it becomes clear that cryptocurrencies have transitioned from niche interests to significant financial instruments that are reshaping how we think about money.

Moreover, the global financial landscape has played a pivotal role in this rise. Economic instability in various regions has led many to seek alternative forms of currency that are not subject to inflation or government control. Cryptocurrencies offer a sense of autonomy and security that traditional financial systems often fail to provide.

As more people become aware of these benefits, we find that the demand for cryptocurrencies continues to grow, leading to increased media coverage and public interest.

The Diversity of Cryptocurrency: Exploring the 10,000 Options

As we explore the vast universe of cryptocurrency, we quickly realize that there are over 10,000 different options available today. This diversity can be overwhelming for newcomers but also presents a wealth of opportunities for seasoned investors. Each cryptocurrency serves a unique purpose and is built on different technological foundations.

For instance, while Bitcoin is primarily viewed as a store of value, Ethereum introduces smart contracts that enable decentralized applications to function on its blockchain. In addition to Bitcoin and Ethereum, we encounter a myriad of other cryptocurrencies that cater to specific niches or industries. For example, Ripple focuses on facilitating cross-border payments for financial institutions, while Chainlink aims to connect smart contracts with real-world data.

This diversity not only reflects the innovative spirit of the cryptocurrency community but also highlights the potential for disruption across various sectors. As we navigate this landscape, it becomes essential to conduct thorough research and understand the underlying technology and use cases behind each cryptocurrency.

Navigating the World of Cryptocurrency: Tips for Beginners

| Topic | Metrics |

|---|---|

| Bitcoin | Market Cap, Price, Volume |

| Ethereum | Market Cap, Price, Volume |

| Altcoins | Market Cap, Price, Volume |

| Wallets | Security, Ease of Use, Supported Currencies |

| Exchanges | Fees, Security, Trading Pairs |

| Regulations | Legal Status, Tax Implications, Compliance |

For those of us who are just starting our journey into cryptocurrency, it can feel like stepping into uncharted territory. However, with the right approach and mindset, we can successfully navigate this complex world. One of the first steps we should take is to educate ourselves about the fundamental concepts of blockchain technology and how different cryptocurrencies function.

Numerous online resources, courses, and communities are available to help us build a solid foundation. Another crucial tip for beginners is to start small and invest only what we can afford to lose. The volatility of cryptocurrency markets can lead to significant price fluctuations within short periods, making it essential for us to approach our investments with caution.

We should also consider diversifying our portfolios by investing in multiple cryptocurrencies rather than putting all our eggs in one basket. This strategy can help mitigate risks while allowing us to explore various opportunities within the market.

Investing in Cryptocurrency: Risks and Rewards

Investing in cryptocurrency presents a unique set of risks and rewards that we must carefully consider before diving in. On one hand, the potential for high returns is undeniably attractive; many early adopters have seen their investments multiply exponentially over time. However, this potential comes with significant risks, including market volatility, regulatory uncertainties, and security concerns related to hacking and fraud.

As we weigh these factors, it becomes clear that a balanced approach is necessary. We should conduct thorough research and stay informed about market trends and developments within the cryptocurrency space. Additionally, employing risk management strategies—such as setting stop-loss orders or using dollar-cost averaging—can help us navigate the inherent uncertainties of this investment landscape.

Ultimately, understanding both the risks and rewards will empower us to make informed decisions that align with our financial goals.

The Future of Cryptocurrency: Trends and Predictions

Looking ahead, we find ourselves at a pivotal moment in the evolution of cryptocurrency. As technology continues to advance and societal attitudes shift, several trends are emerging that could shape the future of digital currencies. One notable trend is the increasing integration of cryptocurrencies into traditional financial systems.

Major financial institutions are beginning to explore blockchain technology and digital assets, signaling a growing acceptance of cryptocurrencies as legitimate financial instruments. Additionally, we are witnessing a rise in decentralized finance (DeFi) platforms that aim to replicate traditional financial services without intermediaries. These platforms offer innovative solutions for lending, borrowing, and trading directly on blockchain networks.

As we embrace these developments, it becomes evident that cryptocurrencies have the potential to revolutionize not only how we transact but also how we perceive value in our increasingly digital world.

Cryptocurrency Regulations: The Changing Landscape

As we navigate the evolving landscape of cryptocurrency regulations, it is essential to recognize that governments worldwide are grappling with how to approach this new financial frontier. While some countries have embraced cryptocurrencies and established clear regulatory frameworks, others remain cautious or outright hostile toward digital currencies. This patchwork of regulations creates both challenges and opportunities for investors and businesses operating in this space.

In recent years, we have seen an increase in regulatory scrutiny aimed at protecting consumers and preventing illicit activities such as money laundering and fraud. As regulations continue to evolve, it is crucial for us to stay informed about changes that may impact our investments or business operations within the cryptocurrency ecosystem. By understanding the regulatory landscape, we can better navigate potential risks while also identifying opportunities for growth in compliance with legal requirements.

The Impact of Cryptocurrency on the Global Economy

The rise of cryptocurrency has far-reaching implications for the global economy that we cannot overlook. As digital currencies gain traction, they challenge traditional financial systems and create new avenues for economic participation. For instance, cryptocurrencies can provide unbanked populations with access to financial services, enabling them to participate in the global economy in ways previously unimaginable.

Moreover, cryptocurrencies have sparked innovation across various industries by encouraging new business models and fostering competition among financial service providers. As we observe these changes unfold, it becomes clear that cryptocurrencies are not merely a passing trend but rather a transformative force reshaping our economic landscape. By embracing this evolution, we can position ourselves at the forefront of a new era in finance that prioritizes inclusivity and technological advancement.

In conclusion, our journey through the world of cryptocurrency reveals a dynamic landscape filled with opportunities and challenges alike. By understanding its fundamentals, recognizing its diverse options, and staying informed about trends and regulations, we can navigate this exciting frontier with confidence. As we look toward the future, it is evident that cryptocurrency will continue to play a significant role in shaping our global economy and redefining how we perceive value in an increasingly digital world.

The world of cryptocurrency is vast and ever-expanding, with thousands of different digital currencies available today. For those interested in exploring the intricacies of this digital financial landscape, it’s essential to stay informed about the latest trends and developments. A related article that delves into the complexities of the crypto world can be found on the Evolution Gaming website. This article provides insights into the dynamic nature of cryptocurrencies and their impact on various sectors, including online gaming. To learn more, you can read the full article by visiting this link.

Open Account — Grab Welcome Bonus

FAQs

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central bank. It is decentralized and typically uses a technology called blockchain to achieve transparency, security, and immutability.

How many cryptocurrencies are there in the world?

As of September 2021, there are over 11,000 different cryptocurrencies in existence, according to data from CoinMarketCap. However, the number of cryptocurrencies is constantly changing as new ones are created and existing ones are delisted or become inactive.

What are some popular cryptocurrencies?

Some popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Cardano (ADA), and Solana (SOL). These cryptocurrencies have gained significant attention and adoption within the crypto community and beyond.

How are cryptocurrencies created?

Cryptocurrencies are created through a process called mining or minting, which involves solving complex mathematical problems or algorithms. This process requires significant computational power and energy consumption. Alternatively, some cryptocurrencies are created through initial coin offerings (ICOs) or token sales.

Are all cryptocurrencies the same?

No, cryptocurrencies vary widely in terms of their technology, purpose, and functionality. Some cryptocurrencies are designed for peer-to-peer transactions, while others are used for smart contracts, decentralized finance (DeFi), or non-fungible tokens (NFTs). Additionally, some cryptocurrencies are more focused on privacy and anonymity, while others prioritize scalability and speed.

Are cryptocurrencies regulated?

The regulatory status of cryptocurrencies varies by country and jurisdiction. Some countries have embraced cryptocurrencies and established regulatory frameworks to govern their use, while others have imposed restrictions or outright bans. It’s important for individuals and businesses to understand the regulatory environment in their respective locations when dealing with cryptocurrencies.